This article first appeared in Beef Central 11th November 2019 and was written to coincide with The Asia-Pacific Bioeconomy Policy Summit part of Bio Innovation Week

AUSTRALIA’S agricultural industry has a bright future with growing global opportunities at every turn.

Despite being globally remote, battling the challenge of being distributed across such a large continent, and the impact of a predominantly arid climate, the nation’s ability to produce agricultural product for the global market sees Australia punching well above its weight.

Australia’s commercial relationships with the rest of the world are driven by a first world economy, underpinned by enormous natural resources, a widely dispersed population and a good helping of ingenuity.

Considering all of this, the nature and scale of the growing global market accessible to Australia is difficult to fathom.

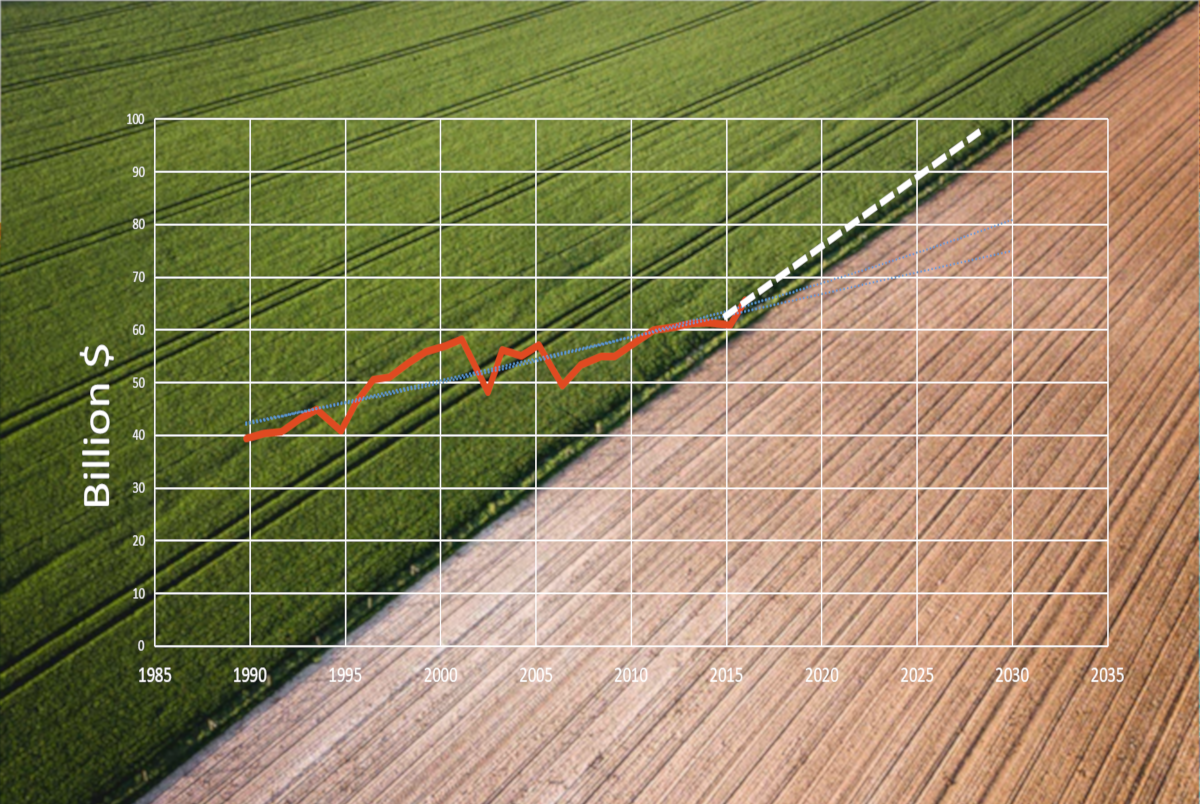

Currently, Australia exports two thirds of all agricultural production to Asia (’16/’17), and our agricultural production sits at $60 billion.

While this figure seems impressive, the National Farmers’ Federation (NFF) is suggesting the country work to build this to $100 billion.

Simple arithmetic shows that $40 billion in additional production would mean domestic markets would be unable to consume the additional output, or even continue to consume the same percentage of output as is currently the case.

This leads to two insights:

1. Growth on the scale the NFF believes possible means the additional production must be targeted at export markets.

2. Unimproved products, agriculture, raw materials and commodities cannot continue to be the basis of the agricultural export economy.

Herein lies the nation’s opportunity.

But if Australia’s bio, ag and farming sectors are to capitalise, the question is, how?

To paraphrase the title of Marshall Goldsmith’s book, ‘What Got Us Here Won’t Get Us There’ — Australia’s industries must ‘grow up’ in order to grow.

No longer can we grow, mine, harvest and export and expect economic prosperity.

Capitalising on new market opportunities demands the development of new products, and the embracing of onshore manufacturing and value-adding.

The strategy of enriching the raw commodities targets a higher share of the consumer spend than Australia’s businesses are used to.

Through innovation, value adding and manufacturing of finished products as opposed to commodities, our $60 billion of production value will increase towards $100 billion without the need to produce additional crops.

To embark upon this, businesses need to know who currently buys Australia’s agriculture output and truly understand whether these are the markets that will continue to buy from Australia. Between 2007 and 2050 the combined Asian market will grow more than 450%.

By 2030, 59% of the dollars spent by the world’s middle class will be spent in Asia.

Across the globe the world’s poorest people are pulling themselves out of poverty and becoming middle-class consumers at staggering rates.

The growth in numbers of these new-world consumers results in an increased global appetite for high-quality, clean and green products from nations like Australia.

The opportunity is at the top of the market, and not in seeking out all things leaner and cheaper.

There are two key considerations that will underpin Australian industry’s ongoing ability to grow into these markets.

Firstly, our ability to innovate. To meet the demand for sophisticated products, we will have to rely on the sector’s ingenuity and innovation. These improvements and new developments, combined with raw commodities, can bring the best we can offer to the world. Secondly, knowing markets exist and accessing them aren’t the same thing.

Businesses must identify new international market opportunities and service the new demand with solutions and products that are refined and targeted in a culturally aligned strategy to the target export market.

As the 2020s play out, new export markets will be dominated by products, opportunities and categories we cannot yet imagine.

To develop and capitalise on these, industry must first understand and embrace the cultures and nuances of each opportunity.

Understanding and innovating will empower businesses to seek out their share of a potential $40 billion windfall.